Excellent Placement In

MBA Fintech (ACCA – UK)

Apex University

Get Started for a Flying Career with Guaranteed Knowledge at Apex University.

MBA Fintech (ACCA – UK)

Get Started with modern approach of learning at Apex University.

Apex University

MBA Fintech with ACCA – UK

UGC Approved Courses

Introduction

MBA (Fintech) from ACCA – UK course at Apex University Jaipur is a 2 year postgraduate programme and has been designed in collaboration with the Association of Certified Chartered Accountants (ACCA), UK and International Skill Development Corporation (ISDC), UK.

The curriculum of Fintech has been completely integrated here. Hence the students get a unique opportunity to pursue Fintech qualification in tandem with their 2 years postgraduate course.

About ISDC

International Skill Development Corporation is a British-based leading Education and Skill

Development company with a vision of bridging the global skill gap. It imparts a set of Skill

Development initiatives through its structured plan and aims at Developing Skills for Tomorrow.

ISDC works with many Governments, Leading Universities and Institutions around the world for

various Education & Skill Development models, innovative and industry-relevant

Undergraduate /Postgraduate programs in various disciplines such as Accounting & Finance, IT,

Applied Science, Media & Entertainment, Logistics & Supply Chain, Marketing, Analytics,

Healthcare …etc. ISDC is working with an excess of 25 Professional Bodies in the UK for their

market expansion and growth globally.

The company actively engaged in various Education Services like Skill Development Projects,

Professional & Vocational Education, Research & Development, and Consulting.

About ACCA

ACCA (the Association of Chartered Certified Accountants) is the Global Body for Professional

Accountants. ACCA offers business-relevant, first-choice qualifications to people of application,

ability and ambition around the world who seek a rewarding career in accountancy, finance and

management.

Founded in 1904, ACCA has consistently held unique core values: opportunity, diversity,

innovation, integrity and accountability. ACCA believes that accountants bring value to

economies in all stages of development. The primary aim is to develop capacity in the profession

and encourage the adoption of global standards. ACCA’s values are aligned to the needs of

employers in all sectors and ensure that, through their qualifications, the finance professionals

are prepared to meet the growing business needs of the corporate world.

Why Financial Technology?

Financial technology (better known as FinTech) is used to describe new technology that seeks to improve and automate the delivery and use of financial services. Financial Technology (FinTech) is here – sweeping through finance and, if some are to be believed, threatening traditional edifices that have stood for centuries.

This great surge is being fronted by a host of new start-ups taking their lead from the big tech innovators. Their maverick approach is helping to push the FinTech industry into new territory across the financial services landscape, raising billions of dollars and worrying the incumbents.

So what are the main trends and driving forces shaping FinTech today? FinTech – transforming finance explores the features of this new landscape, highlighting the many ways in which this revolution is taking place.

For professional accountants, this new terrain will provide many opportunities as it permeates deeper and deeper into the fabric of society. From the promise of block chain, to the demands of valuation in a digital era, finance more than ever needs an experienced, knowledgeable guide to make the most of the opportunities ahead

Duration / Schedule

2 Years (4 Semesters)

Eligibility Criteria

Passed in Bachelor’s degree (any discipline) or equivalent. Obtained at least 50%

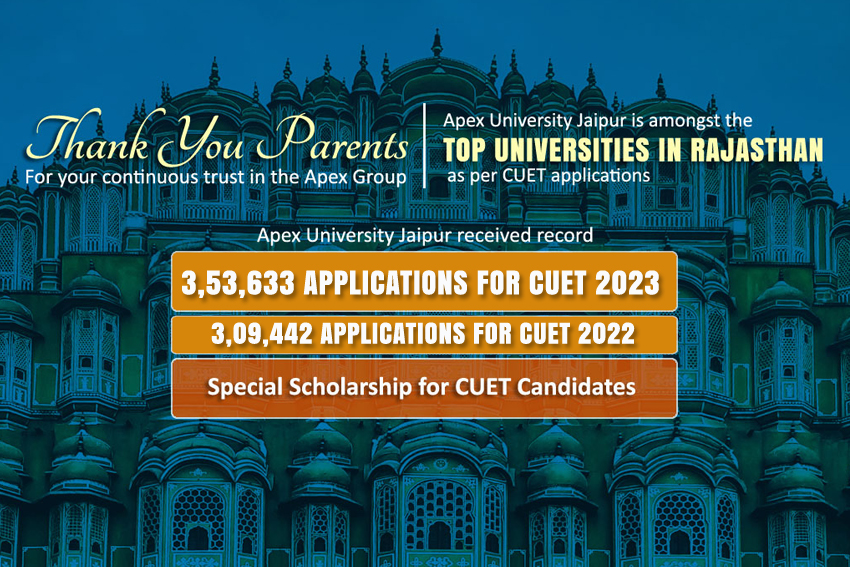

Seat Metrix

50% through APEX Merit

50% through CUET Merit

Key Highlights

– A blend of Financial Technology – Artificial Intelligence (AI), Machine Learning, Robotic Process Automation (RPA) and intelligent automation which is the need of the future.

– Develops skills to modify, enhance, or automate financial services for businesses or consumers.

– Focuses on Investment management and decision-making models for those in the finance industry.

– Industry designed curriculum that delivers technical excellence and supplements professional skills.

– A host of Skill Enhancement and Ability Enhancement Courses in addition to Core Course.

Placements

We are Apexians

We are everywhere

Apex has a long journey of academic excellence and The Apexians are now placed all over the world.

Placement Cell

We have a competent placement Cell which support the students to build better future.

Apex University

INSPIRING INNOVATION

INR 97 Lacks

Per Annum Package

Build your

perfect Career

with Apex

The Apex Foundation is being recognized and affiliated with lots of authorities and served the society with a world class infrastructure and quality education.

Placement Support with Academic Excellence

At Apex, We deliver quality education, which leads to a better future.

Apex University

INSPIRING INNOVATION

100%

Placement Support

Rakesh Kumar

CEAT Tyres

CEAT Tyres

Parul Jain

ICICI Bank

ICICI Bank

Priyanka Yadav

AU Bank

AU Bank

Vanshita Joshi

ICICI Bank

ICICI Bank

Mahesh Chand

PayTM

PayTM

Prince Soni

A3Logics

A3Logics

Pooja Sharma

INR 97 Lacs Per Annum

INR 97 Lacs Per Annum

Ajay Tiwari

INR 4.5 Lacs Per Annum

INR 4.5 Lacs Per Annum

Alok Pandey

INR 4.5 Lacs Per Annum

INR 4.5 Lacs Per Annum

Vipin Sharma

INR 3.6 Lacs Per Annum

INR 3.6 Lacs Per Annum

Ranking

Programme Highlights

MBA Fintech – ACCA, UK

Overview

The MBA (FinTech) from ACCA – UK covers the Financial Technology subjects in line with the modern technological innovation in the design and delivery of financial services and products. Financial Technology is the synergy between finance and technology that is used to enhance business operations and the delivery of financial services.

ISDC – International Skill Development Corporation is a British-based leading Education and Skill Development company with a vision of bridging the global skill gap. It imparts a set of Skill Development initiatives through its structured plan and aims at Developing Skills for Tomorrow. ISDC works with many Governments, Leading Universities and Institutions around the world for various Education & Skill Development models, innovative and industry-relevant Undergraduate /Postgraduate programs in various disciplines such as Accounting & Finance, IT, Applied Science, Media & Entertainment, Logistics & Supply Chain, Marketing, Analytics, Healthcare …etc. ISDC is working with an excess of 25 Professional Bodies in the UK for their market expansion and growth globally. The company actively engaged in various Education Services like Skill Development Projects, Professional & Vocational Education, Research & Development, and Consulting. Visit: www.isdcglobal.org

• A blend of Financial Technology – Artificial Intelligence (AI), Machine Learning, Robotic Process Automation (RPA) and intelligent automation which is the need of the future.

• Develops skills to modify, enhance, or automate financial services for businesses or consumers.

• Focuses on Investment management and decision-making models for those in the finance industry.

• Industry designed curriculum that delivers technical excellence and supplements professional skills.

• A host of Skill Enhancement and Ability Enhancement Courses in addition to Core Course.

Best MBA college in Jaipur | Top Ranked University for MBA | ACCA-UK | MBA University

Employment Opportunities in Big 4’s, Big 6’s and Fortune 500

FUTURE SCOPE

We have a vision to produce world-class professionals. We are committed on these objectives :

– Fintech Innovation and Disruption : The future of the financial industry lies in fintech innovation and disruption. Graduates of MBA Fintech with ACCA – UK will be equipped with the knowledge and skills to navigate this rapidly evolving landscape. They can drive digital transformation, develop innovative fintech solutions, and leverage emerging technologies such as blockchain, artificial intelligence, and data analytics to revolutionize financial services.

– Leadership in Digital Finance : As the fintech sector continues to grow, there will be a demand for leaders who can effectively navigate the intersection of finance and technology. MBA Fintech graduates with ACCA – UK certification will possess a strategic understanding of both domains, enabling them to lead organizations and shape the future of digital finance. They can hold executive positions in fintech startups, financial institutions, or even launch their own ventures.

– Risk Management and Regulatory Compliance : The integration of technology and finance brings forth new risks and regulatory challenges. Future opportunities lie in risk management and regulatory compliance roles, where MBA Fintech graduates can leverage their expertise to ensure the security and compliance of fintech operations. They can play critical roles in managing cybersecurity, data privacy, and regulatory adherence in fintech organizations.

– Global Career Opportunities : Fintech is a global phenomenon, and MBA Fintech graduates with ACCA – UK certification will have a global outlook and market recognition. They can explore diverse career opportunities in international fintech hubs, financial centers, or multinational corporations. Their expertise in fintech strategy, financial management, and regulatory frameworks will make them sought-after professionals in a digitally connected world.

APPLY NOW

LIFE @APEX

INDUSTRY PROSPECTS

Fintech Leadership Roles : Graduates of MBA Fintech with ACCA – UK can pursue high-level leadership positions within the fintech industry. They can aspire to become chief technology officers, chief digital officers, or fintech consultants, leading organizations in their digital transformation efforts and driving innovation in financial services.

Fintech Startups and Entrepreneurship : The fintech industry is ripe with opportunities for entrepreneurship. MBA Fintech graduates can leverage their knowledge and skills to launch their own fintech startups, creating disruptive solutions, and attracting investment. They can apply their understanding of finance, technology, and business strategy to build scalable and successful ventures.

Financial Institutions and Banks : Traditional financial institutions are increasingly embracing fintech to enhance their services and stay competitive. MBA Fintech graduates can find opportunities in banks, investment firms, and financial institutions, where they can lead digital transformation initiatives, implement fintech solutions, and drive innovation within established organizations.

Fintech Consulting and Advisory Services : Fintech consulting and advisory services are in high demand as businesses seek expert guidance in navigating the fintech landscape. MBA Fintech graduates can work as consultants, offering strategic advice, conducting feasibility studies, and helping organizations adopt fintech solutions that improve efficiency, customer experience, and profitability.

USP :

Overall, graduates of the MBA programs can look forward to exciting and challenging career opportunities in various industries, where the skills and knowledge can be applied to solve real-world problems and drive innovation.

Life @Apex

Apex University

MBA Fintech – ACCA, UK

Apex University

Explore The Endless Opportunities.

Research

Research is crucial in academic institutions as it contributes to the advancement of knowledge, enhances institutional credibility and reputation, promotes practical applications, develops critical thinking and analytical skills, and promotes innovation and creativity. It helps to expand the boundaries of knowledge and improve understanding of various subjects. Research output reflects the quality of education and intellectual atmosphere of an institution. Research findings can be applied to solve real-world problems and improve people’s lives. It provides opportunities for students to develop critical thinking and analytical skills. Therefore, it is crucial for academic institutions to invest in research and provide adequate resources and support for research activities.

Build Your DREAMS

Go beyond just learning. Whenever you like, wherever you go

Modern Laboratories

Apex University has ultra modern infrastructure to cater the needs of quality education.

Modern & Smart Library

Apex University has ultra modern infrastructure to cater the needs of quality education.

Related Courses

management Courses

BBA

(H) IAF (ACCA-UK)

BBA

(H) Strategic Finance (USCMA- US)

BCom

(H) Strategic Finance (USCMA- US)

BCom

(Hons) IAF (ACCA- UK)

Apex University

Industrial Tie-ups

Testimonials

FAQs

Q. What jobs should you look for after doing Fintech ?

A. i) Financial Analyst

ii) Risk Management Specialist

iii) Product Analyst

iv) Information Security Analyst

v) Block chain Engineers

vi) App Developer

vii) Product Designer

viii) Cyber Security Specialist

ix) Compliance Specialist

x) Cloud Engineer

xi) AI Strategy Manager

xii) Automation Manager

Q. What is the admission Procedure ?

A. Based on Apex Merit or CUET merit along with Personal Interview.

Q. How can I apply ?

A. You should register yourself and submit your online application. You will get an email on your registered email.

Q.If I have any queries regarding the course whom should I connect ?

A. You can talk to our Admission Counsellors and Experts on these numbers : +91-7413874138 or you can mail to : info@apexuniversity.co.in

Q. Few of the organizations where Fintech’s are employed in India include :

A. i) Accenture

ii) AIG

iii) Genpact

iv) EY

v) KPMG

vi) Deloitte

vii) PwC

viii) Johnson & Johnson

ix) Caterpillar

x) VMware

xi) Flextronics

xii) Capgemini

xiii) World Bank

xiv) Cognizant

xv) JP Morgan Chase

xvi) Invesco

xvii) WNS

xviii) Synchrony Financial

xix) AXA Insurance

xx) Philips

xxi) Qualcomm

xxii) Grant Thornton

xxiii) BDO

xxiv) Tata Power

xxv) Maersk

xxvi) Red Hat

xxvii) Diageo India Private Limited

xxviii) Ford

xxix) Barclays

xxx) Aon PLC

xxxi) MetLife, Inc.

xxxii) Electronic Arts

xxxiii) Alexion

xxxiv) DuPont

xxxv) Max Life Insurance

xxxvi) Fidelity National Information Services, Inc.

xxxvii) EXL Service

xxxviii) Citrin Cooperman

xxxix) TE Connectivity